The primary area of consideration of our investment process is the future free cash flow generating ability of the businesses we invest in.

Our belief is that a business that can generate a true economic profit after capital expenditures (free cash flow) in all economic environments creates a margin of safety for our investment.

This free cash flow is not the popular “EBITDA” or earnings before interest, taxes, depreciation and amortization; rather, free cash flow is defined as cash from operating activities lesscapital expenditures.

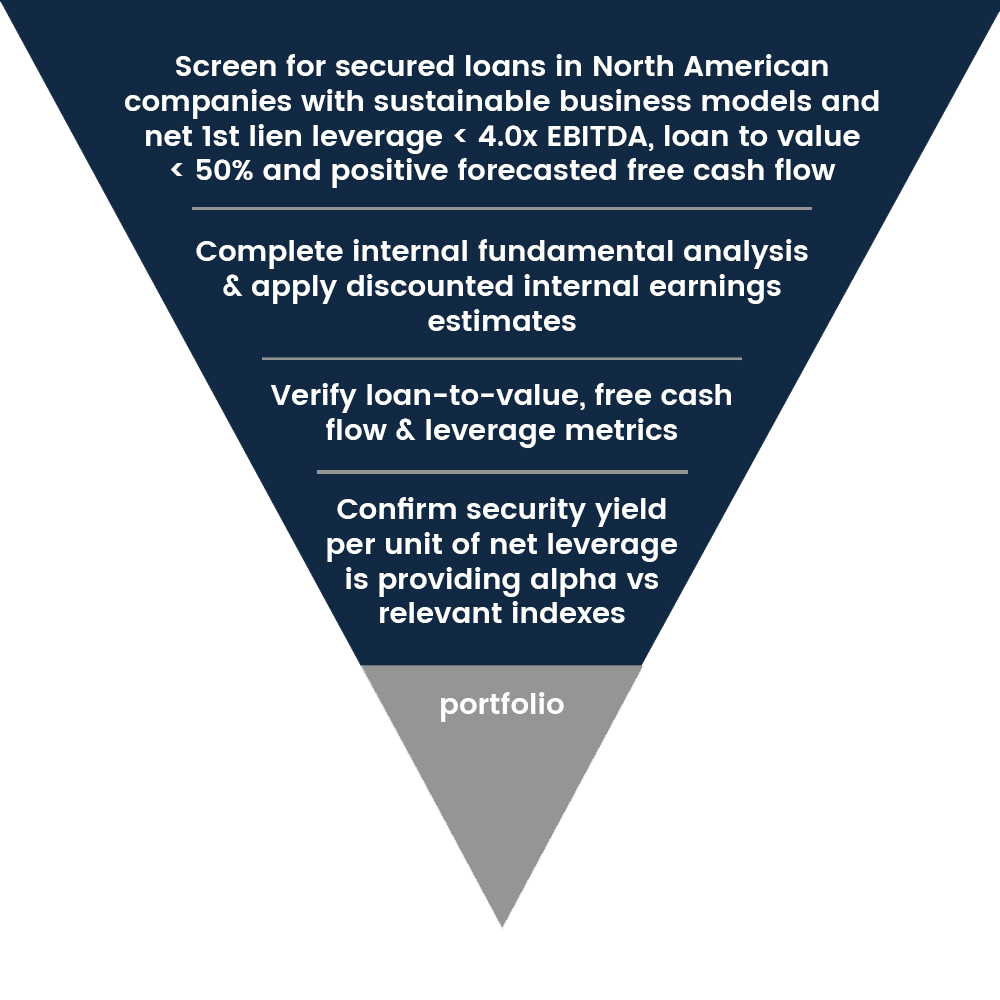

While this process by itself is not completely unique among active credit managers, the key for us is in identifying what we see as undervalued securities or mis-priced risk.

While we undertake a very detailed fundamental credit analysis of every company, Peritus focuses on three key financial metrics for all loan investments:

1. Net 1st Lien Leverage

2. Loan to Value

3. Forecasted Free Cash Flow

Our process …